SBI Small cap fund has reopened its door for subscription and I see many eager investors queening up to invest in this fund…and why not…this was one of the best performing funds but had stopped taking new money as they couldn’t find enough opportunities in the small cap space. Now that they have reopened the gates for investments…let’s look at some good funds in this category as well…

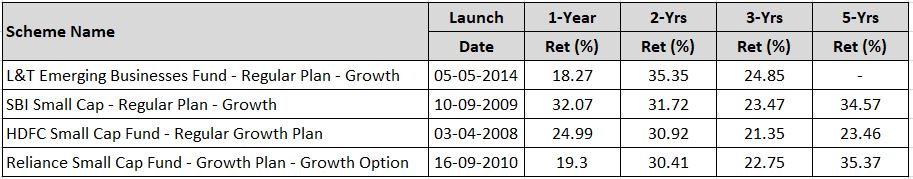

Data as on – 18-05-2018

While the returns have been exceptionally well, the investor should understand that the small cap space is very volatile and should not invest unless you have a minimum 10+ yrs time horizon. Also, at this point the preferred way to invest is through the SIP route.

I believe, anyone who is planning for a retirement fund or has a long-term goal of 15-20 yrs, should have some small/mid cap exposure as this could help you improved the overall return for your portfolio.

If you have already made investments and don’t want to do an SIP for that long…here is an alternative…

If you are 40 yrs old now, You can do a 10K/month SIP for 5 yrs or 5K/month SIP for 10 yrs., your total investment will be 6 lakhs and at 15-16% CAGR, you would have 60 lakhs after 20 yrs. i.e. when you turn 60 yrs.

As you can see from the above table, most of the funds have delivered more than 20% returns but I have considered lower returns and still we can get 10 times the money invested.

Also, an important point with market linked investments is to have a 2-3 yr leeway, so if you want to withdraw the funds after 20 yrs, you should start looking for a good opportunity from 18th year and move the funds to a stable conservative fund.

Hope this was helpful. We can help you plan & invest for any or all of your financial goals…email or call to book an appointment for a discussion – Invest@smartserve.co / 9916804769

We also have a Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Happy Investing

Robin