I am sure you have already heard about the implementation of LTCG for equity and equity mutual funds. In this article, I will try to analyse the impact on our investments and analyse, if its worth moving our investments elsewhere…

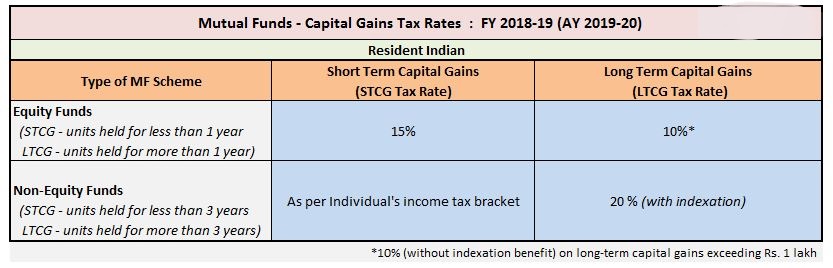

Long Term Capital Gains (or LTCG) arising from the sale of equity shares and equity mutual funds will be taxed at 10%, if total capital gains in a year exceed Rs 1 lakh.

This was tax free for sometime now and the Govt had given that exemption to get more retail participation in equity…it was never intended to be kept tax free for ever. Infact, the return of LTCG on equities was expected for many years and hence, cannot be called as a very big surprise.

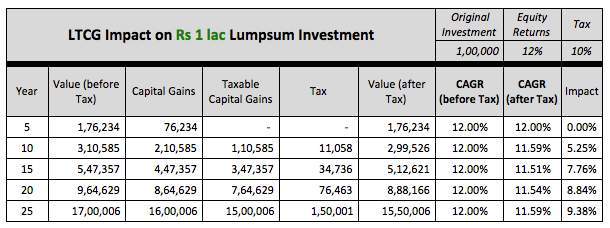

Below table shows you the impact of LTCG on a 1 lakh investment.

As you can see the impact on the final corpus is approximately 10% but the effect on yearly return/CAGR is hardly 0.5%. Here we have taken a very conservative 12% and we have seen in the past that equities and many of the equity mutual funds have given more than 14%-15% CAGR.

Most of the other traditional products give you only a post tax return between 5.5% to 7.5% and hence even a 11.5% on MF looks much better…but let me give you an example to show you the impact of this over a long period of time…

Lets assume you invest 10 lakhs towards your retirement fund which is 25 yrs away. Here is the final amount that you can expect after 25 yrs…

@5.5% CAGR – 38.13 Lakhs

@7.5% CAGR – 60.98 Lakhs

@11.5% CAGR – 1.52 Cr

So…I wouldn’t worry about the 0.5-1% impact because of LTCG. Equities & mutual funds are still the best way to create wealth over a long period of time and l believe that there is good chance that you will get better than 11.5% annual returns over a long period of time.

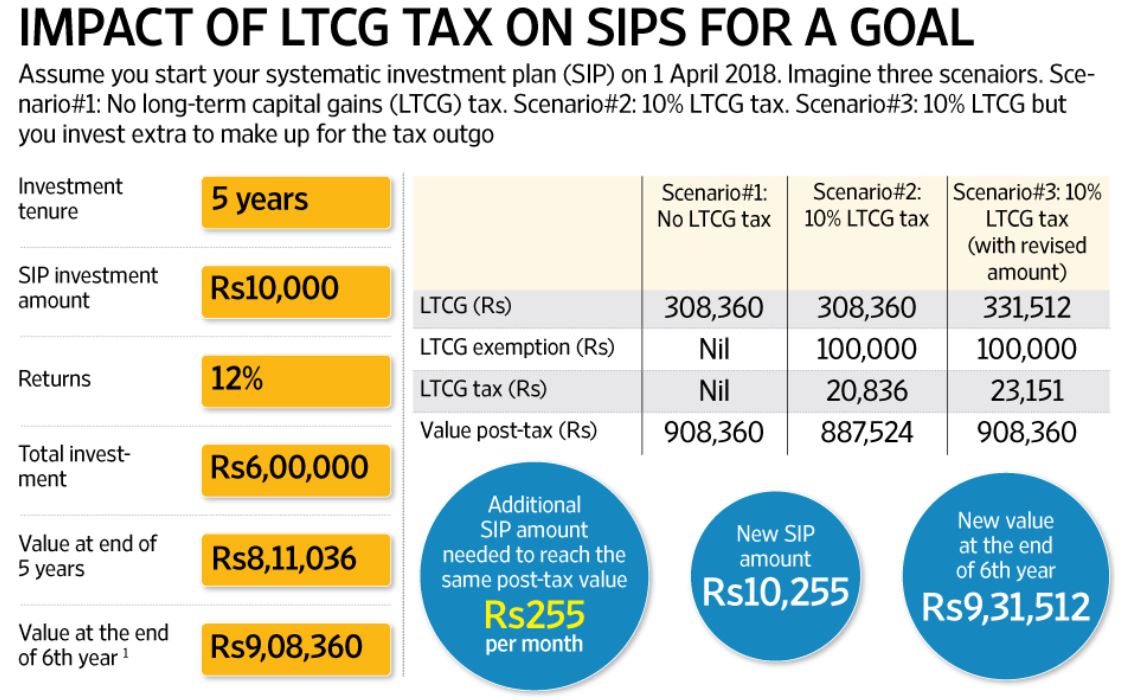

Here is an impact analysis of LTCG on SIP’s…

It is assumed that the SIP will end at the end of 5th year, but we withdraw at the end of 6th year to avoid paying STT for the SIP investments of 5th year.

As you can see that an SIP of Rs 10000 for 5 yrs will become Rs 908360 at 12% CAGR by end of 6th year. While earlier we didn’t have to pay any taxes buy now with LTCG will have to pay Rs 20836 as tax. So the net impact on annual returns/CAGR is 0.7%… which is still very good.

In case you had calculated your goal amount at 12%, Even with LTCG, you wouldn’t have to worry as there is a good chance you will meet and exceed your expectation as we have seen in the past years but if you want to be extra cautious, you can increase the sip amount slightly…for e.g. in this case, if you increase the SIP amount by Rs 255…you will get the same amount of Rs 908360 as compared to Rs 887524.

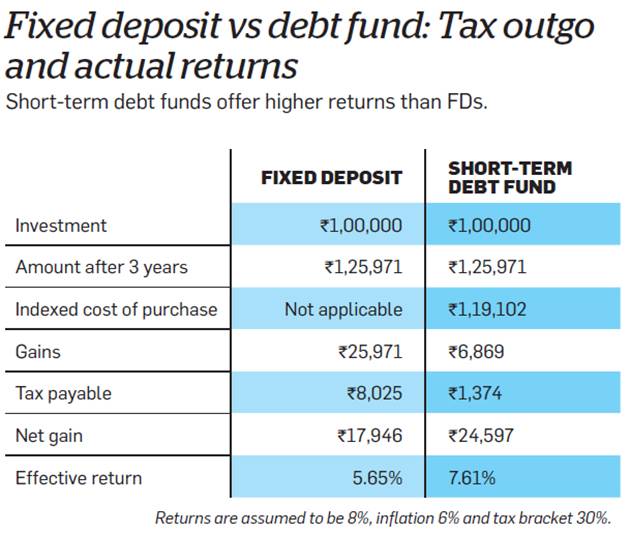

Now that we are on the topic of taxation…here is comparison of Debt fund Vs Bank FD

Debt fund is ideal for conservative short term investors who can’t digest the volatility of equity markets and are considered safer than equity funds. Debt Mutual Funds mainly invest in a mix of debt or fixed income securities such as Treasury Bills, Government Securities, Corporate Bonds, Money Market instruments and other debt securities of different time horizons.

In debt funds – LTCG is applied after 3 yrs and it is taxed after indexation and hence is it very tax efficient as shown the below example.

I hope this was helpful. Pls. mail us at Invest@smartserve.co or call 9916804769 for consultation or investments needs also pls. share you comments below…

We also have a Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Thank you

Robin