HDFC AMC’s IPO was oversubscribed 83 time and today it got listed at a 58% premium, it closed 65% higher.

Why was there such a mad rush for this ipo??

The Answer is Brand/pedigree of HDFC and the track record of the Promoter/Management behind it. The HDFC Group stocks have been such phenomenal wealth-creators that no investor wants to miss any opportunity to pick up a stock with the HDFC brand tag.

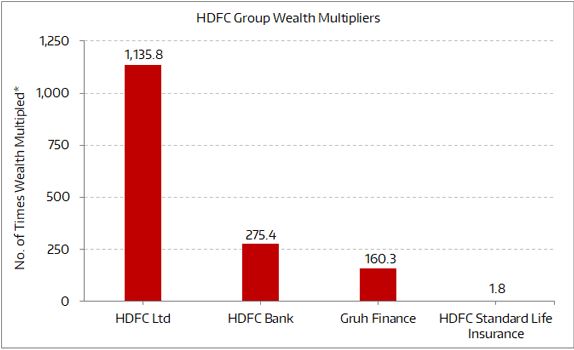

If you had invested in the initial phase of any of the HDFC companies and stayed …here is how it would have multiplied your investments…

In the chart above, I’ve taken the earliest available prices for HDFC Ltd, HDFC Bank, and Gruh Finance.

HDFC Ltd: 4 Jan 1990;

HDFC Bank: 26 May 1995;

Gruh Finance: 28 Jan 1993;

HDFC Standard Life Insurance: Nov 2017 Issue price.

The returns translate as below:

HDFC Ltd delivered compounded returns of 28% over 28.6 years. (Investment grew by 1135 times in 28 yrs)

HDFC Bank delivered compounded returns of 27% over 23.2 years.(Investment grew by 275 times in 23 yrs)

Gruh Finance delivered compounded returns of 22% over 25.5 years.(Investment grew by 160 times in 25 yrs)

HDFC Standard Life Insurance delivered absolute gains of 75% in a little over eight months from its issue price of Rs 290 per share.(Investment grew by 1.8 times in 8 months)

While its important to look at Business, financials & growth matrices, Management quality is one of the most important factors when choosing stocks to invest for long term.

Happy Investing!!!

We can help you plan & invest for any or all of your financial goals…through stocks and mutual funds. Please email or call to book an appointment for a discussion – Invest@smartserve.co / 9916804769

We also have an open Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Thanks & Regards

Robin