Many investors have been investing in funds like HDFC prudence to meet their monthly cash flow requirements through tax free dividends. HDFC Prudence fund has been giving almost a 12% annual dividend…paid out monthly. For eg, if you had invested Rs 10 Lakhs in this fund….you would be getting almost Rs 10000/- as dividend pay-out every month and which was completely tax free. For this reason many investors have invested heavily in this fund and the funds AUM currently stand at an astounding Rs 33000 Cr +.

While this fund has been giving monthly dividends for the last 2 yrs, in case of market crash…it could pause…as the dividends are paid only on the profits made by the fund. So the better option was always SWP…but as dividends were paid immediately and it was tax free so it was lucrative for many…

But now with the introduction of Dividend Distribution Tax (DDT) @ 10% (plus surcharge, as applicable and cess) for dividends paid on equity oriented mutual funds, investing in dividend option of equity oriented mutual funds may be less tax efficient. Alternatively, investors can use the Systematic Withdrawal Plan (SWP) to meet their monthly cash requirements in a tax efficient manner.

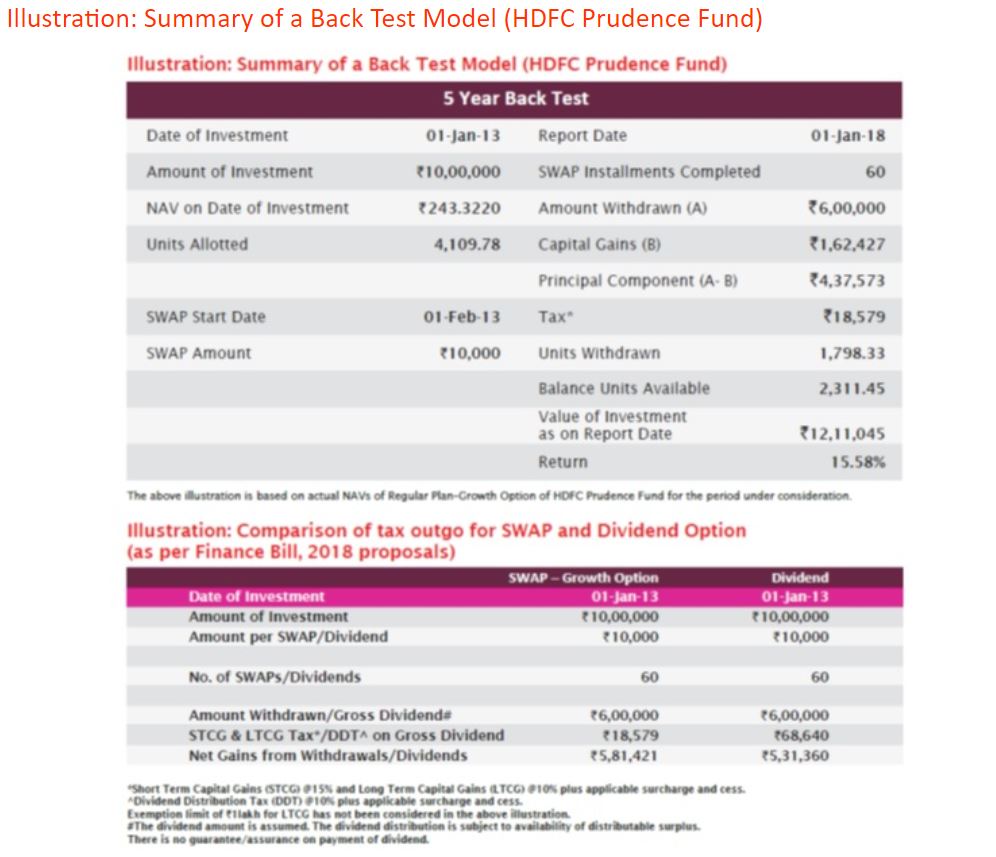

Here is an illustration to show you the advantage..

The above table shows the impact of proposed taxation for investment in dividend option vis-a-vis SWP in Growth option of HDFC Prudence Fund. Under dividend option, net tax outgo on dividends of Rs 6,00,000 would be Rs 68,640 and under growth option net tax outgo on withdrawal of Rs 6,00,000 would be Rs 18,579. Thus, post the proposed changes in taxation, opting for SWP under Growth Option would be more tax efficient.

We can help you plan & invest according to your needs and goals, email or call to book an appointment for a discussion – Invest@smartserve.co /9916804769

We also have a Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Happy Investing

Robin