When we invest in Gold or Property (land/flat), we want to acquire it at lower price and after we have done our buying, we want the prices to go up…which is fine as this is a rational behavior. We have to invest when the prices are low so that we can get maximum profits when the prices go up.

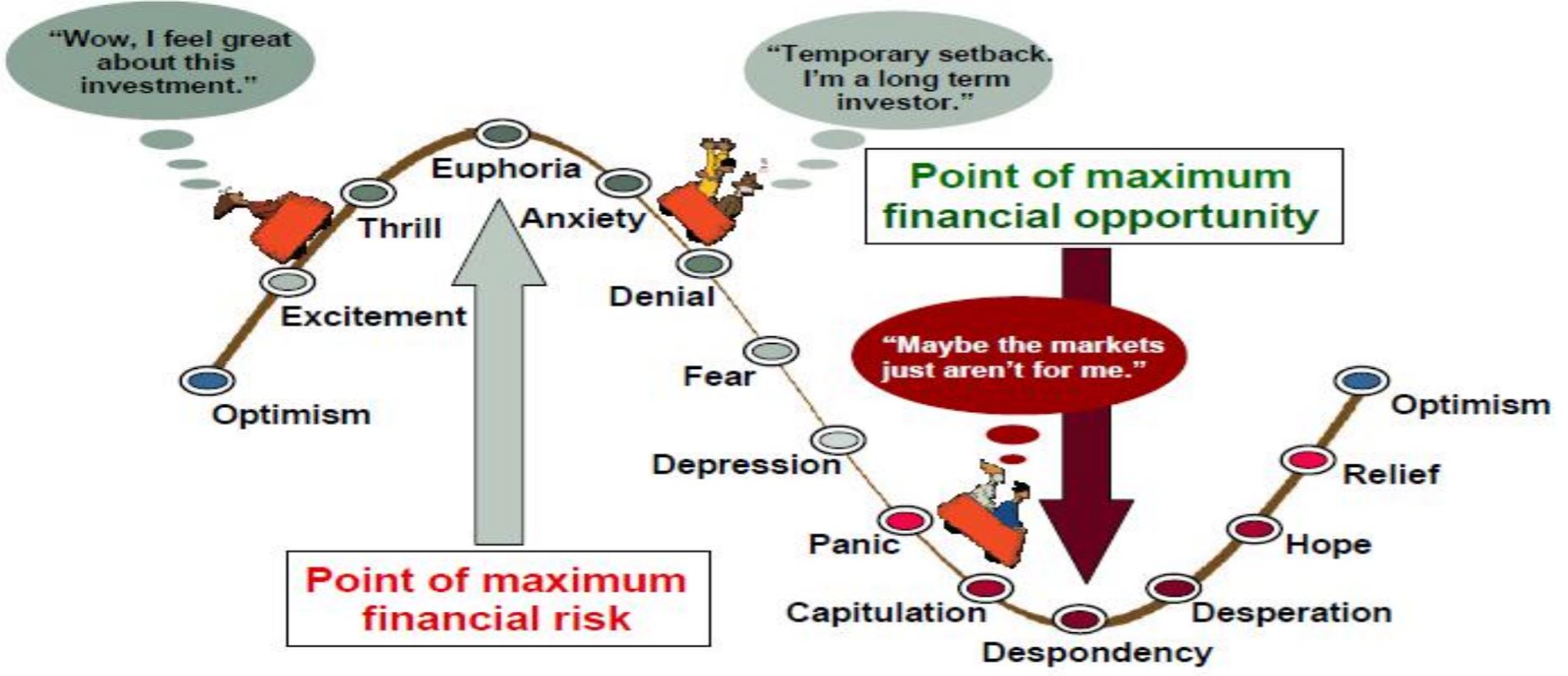

But in case of stocks and mutual funds many investors do exactly the opposite, they enter when the markets are high and leave when the markets are low, blaming the markets for the loss.

The recent bull markets started in 2014 and the peak was 2017, The investors were happy because of stellar returns on their investments. Seeing these high returns, a lot of new investors joined the bandwagon with the expectation of similar returns…to be disappointed with the pause and correction in 2018.

Many of your funds will be showing lower returns especially if you have started in the last 1 year. Do not worry, As I mentioned earlier…this is the time to invest…when there is correction, you get to buy the stocks and funds at cheaper prices. So ideally during correction, increase your investments or at lease continue your SIP’s and as the markets starts to climb up again…you can sit back and enjoy the ride.

Let’s look at some past examples, the two big corrections – 1999-2000 and 2007-2008. If you started a SIP on the Sensex one year before the 1999, your Sensex return between Feb 99 and Feb 2000 which was a market top, would have been 65.3% returns. So something very similar to what happened when people came in small and mid-cap in 2017.

In 2000 February, the market corrected and within 3 months, the 65.3% return was down to 1.1%. When the market bottomed in October 2001, that return further went down to -25.4%. If the investor had not panicked and continued the SIP, after 5 years, the SIP return on the entire book was 17.1%.

So it is a very similar situation today. The market grew very fast. In this case, small and mid-caps grew around 40-50% on the index while the large caps went up by around 20% – and then we had the mid and small caps correction. The same thing happened in 2007-2008 which is a more recent memory for many. An investor who started his SIP in Jan 2007 got an 80% plus return in the first one year, only to see the return collapse to 10% just 3 months later and then sink to -39% at the market bottom. From that level, 3 years later, his SIP return recovered to a healthy 17% CAGR

Fact is that while between Jan 2003 and Jan 2008, NIFTY actually delivered a return of 35%+, there are 4 occasions where the NIFTY corrected sharply – it fell by more than 20% twice, by 14.5% once and by 12% once. However, we have forgotten that. Between May 2006 and June 2006, which is just a matter of 5 weeks, the index corrected 29.8% percent. Despite it, we have had a return of 39.5% from 2003-2008. These are the stories we should remember.

To conclude, corrections are good times for people looking to invest, its like a sale in a supermarket – a bargain deal. Increase your investments through good funds…if not, at least do not stop, be patient and continue with your existing SIP’s and in the next few years when markets achieve new highs again…you will be a very happy investor 🙂

We can help you plan & invest for any or all of your financial goals…email or call to book an appointment for a discussion – Invest@smartserve.co / 9916804769

We also have a Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Prudent investing.

Robin