Goal Based Investment Planning

The first step in goal planning is to document the time line to goal. You goal can be Child’s education, marriage or your own retirement. It can also be a short term goal like a vacation or buying a car etc.

Once you know the time line, you would need to calculate the impact of inflation on your goal. For e.g if the cost/expense of marriage is say 20L, it would definitely not remain the same after 10 yrs. Inflation reduces the purchasing power of your money and hence the price goes up over a period of time. You can assume 5-6% inflation in your calculations…but for few things like healthcare and Education…it is much more, would suggest you to consider 10%.

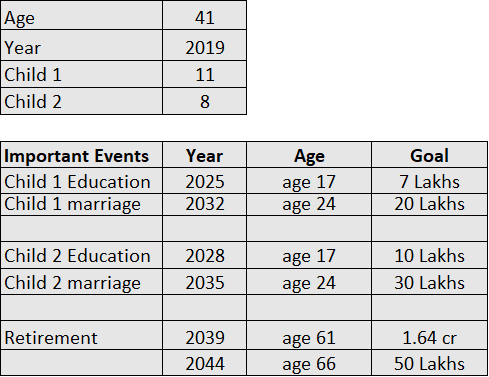

Below is an example to show you the impact of Inflation on your financial goals…

Once you have identified the goal amount, you will need to identify the best available investment products which can help you reach the goal. For long term, I believe equity can give you the best returns. The belief is based on not just the analysis of Indian markets, World over… Equity as an asset class have delivered superior returns compared to any other asset class like FD’s, Bond, Gold, property etc.

Below is a table showing investment growth at 12% CAGR..

Here is one of the ways to plot goals / time of withdrawal :

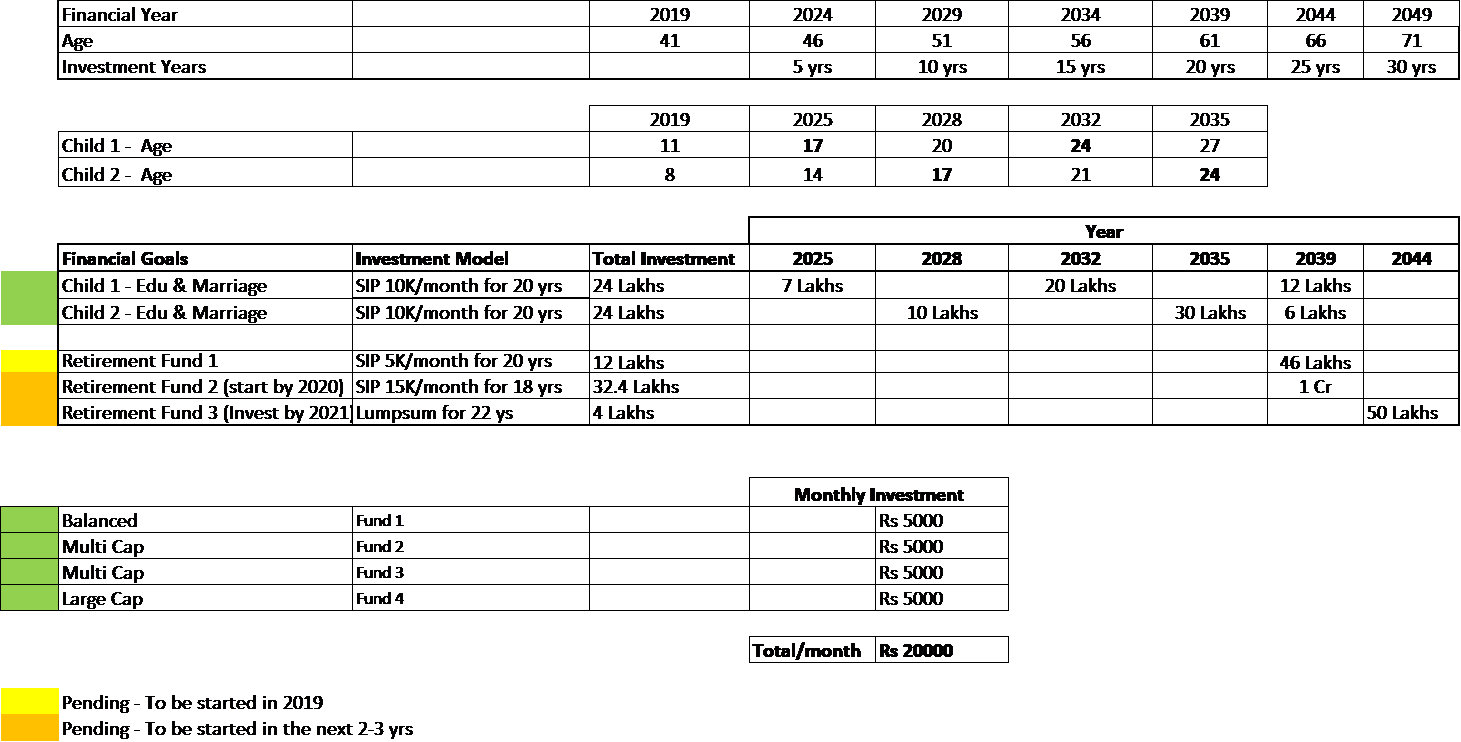

Here is how you can plot the investment plan to meet the goals:

This is just a sample to show you the planning process, please consult your financial adviser before making an investment.

Here is another way to build a corpus, suitable for investors who want to invest for only 3-5 yrs ;

We can help you plan & invest for any or all of your financial goals…email or call to book an appointment for a discussion – Invest@smartserve.co / 9916804769

We also have a Telegram group to discuss and share matters related to Investments – Stocks, Bonds, Mutual funds and all aspects of Personal Finance. I invite you to join the group by clicking on the below link…

https://t.me/joinchat/I4WECg9uRygPBedJkHJGZA

Happy Investing

Robin