Correction is temporary, Growth is Permanent

The markets have corrected but were we not expecting a correction? Corrections are a part of the market cycle. Look at the last 35+ yrs and you will see many instances when the markets were down…but it has always come back. People who stay invested or invest more during this “down” period are the biggest beneficiaries.

Its like a sale…the things that you were buying at say Rs 100 earlier is now available at Rs 80 – 90 and over the next 3-5 yrs the price can go to 130-150+…so if you buy during this time…your average cost comes down and when the markets goes up…the investors who stayed invested or increased their investments during the down phase will gain the most.

It’s the same with shares and mutual funds. In mutual funds, you buy units, The price of the unit is NAV. When the markets are down, you get to buy more units. So with Rs 10000 if you bought 1000 units last month…this month you get to buy 1100 or 1200 units…similarly when you are doing SIP, you accumulate more units when the markets are down and hence the cost (avg unit price) comes down and when the markets rebound, you get to make very good returns.

Few instance of correction in the past :

In 1992 (Harshad Mehta scam), Sensex crashed by 54% in 1 year, It jumped 127% post that in 1.5 yrs

In 2000 (IT bubble burst), Sensex crashed by 56% in 1.5 years, It jumped 138% post that in 2.5 yrs

In 2008 (Lehman Crisis), Sensex crashed by 61% in 1 years, It jumped 157% post that in 1.5 yrs

In 2010 Sensex corrected by 28% in 1 year, It jumped by 96% in 3 years post that.

Fact is that while between Jan 2003 and Jan 2008, NIFTY actually delivered a return of 35%+, there are 4 occasions where the NIFTY corrected sharply – it fell by more than 20% twice, by 14.5% once and by 12% once. However, we have forgotten that. Between May 2006 and June 2006, which is just a matter of 5 weeks, the index corrected 29.8% percent. Despite it, we have had a return of 39.5% from 2003-2008. These are the stories we should remember.

2018 – The markets have corrected by almost 12% from its peaks primarily fueled by macro-economic factors like rupee depreciation, crude oil price rise, US/China trade war, Rising bond yield and interests in the US and our own ILFS fiasco. While the Govt. is at the forefront of resolving the ILFS issue, We also believe the macro factors are very near to the peak and we are already trading below fair value on Nifty. If our corporate earnings come out good, the correction will not last very long and we should see a trend reversal.

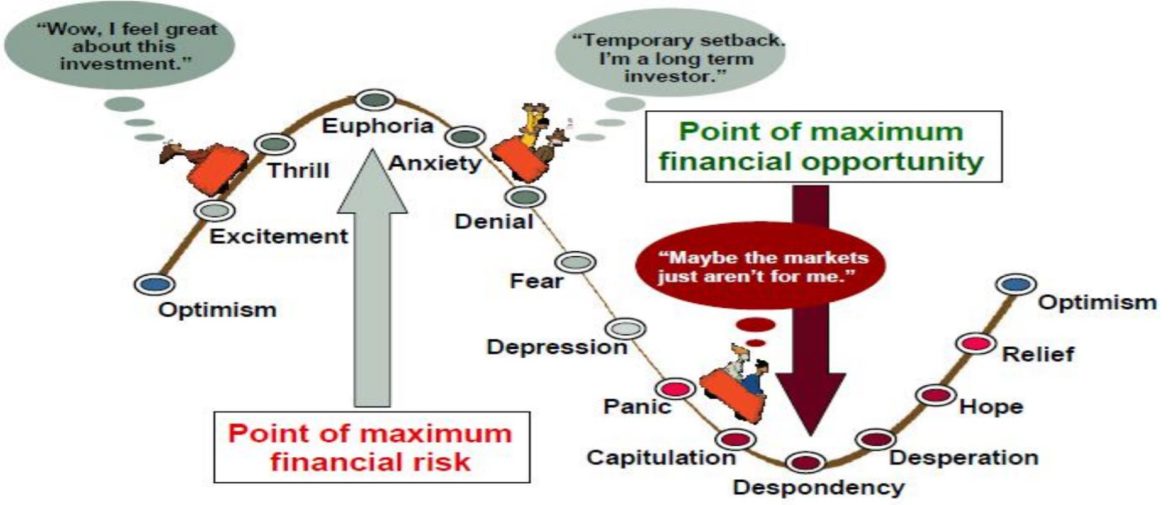

As many great investors have said – Be fearful when others are greedy and Be greedy when others are fearful. This is the time to be greedy, many good companies/stocks are available at very low/attractive valuations. This is the time to invest more and get your friends and family to start investing in equity, if they have not started yet.

We can help you with direct equity as well as mutual funds. We provide complete end to end solution from account opening to research and execution.

Mutual funds : We can help you plan & invest for any or all of your financial goals. We do a complete financial plan and identify and best suitable funds and modes (SIP/Lumpsum) to achieve those goals.

Direct Equity : We provide world class research to identify fundamentally strong companies/stocks to invest and can also do the execution on your behalf. We have multiple strategies for stocks and derivative to help investors achieve superior returns.

Please email or call for any queries : Invest@smartserve.co / 9916804769

Stay Invested

Regards

Robin