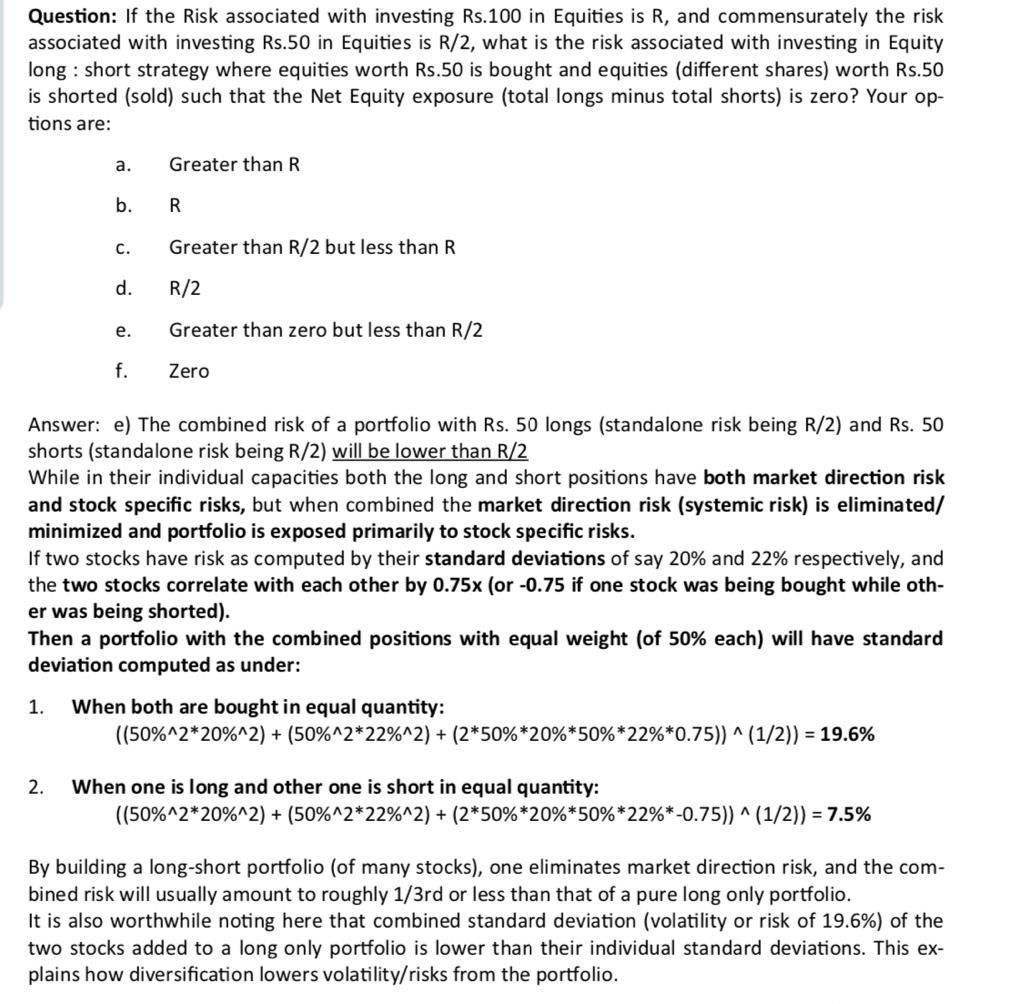

Long – Short Strategy (Non-discretionary portfolio product)

The strategy intends to generate returns in all market phases. Participates in both value creating opportunities and shorting wealth destruction opportunities thereby generating positive returns with low volatility irrespective of market condition.

Investment Objective:To generate absolute returns over the medium term, with reduced volatility. The strategy is targeting 24%+ p.a. returns irrespective of market conditions – Bull as well as Bear.

The Long-Short strategy cuts equity markets directional risk & interest rate risks associated with the bond market and is a low volatility yet decent returns product.

The strategy aims to generate consistent returns for the investors irrespective of market phases. The investment is expected to be profitable every year. There will be short periods of low to negative returns and which will likely be recovered quickly. Additionally, any downside that investors experience will be significantly lower than what one experiences in pure equity/stock investment.

The combined equity derivatives (hedge portfolio) positions in the account will cut the market direction risk significantly. So minimized equity market directional exposure, limited single stock exposure, and support of steady fixed income accruals should protect the account from any large downside. High returns forecast is based on contributions from each of asset allocations- namely Fixed Income and Hedge portfolios.

Example : The Investment advisor identifies two stocks in the same industry. Let’s assume Company X &Y from the banking sector. The advisor identifies X is trading above fair value and Y is below fair value/mean and hence the advisor will go short on X (makes money when stock falls) and long on Y(makes money when stock moves up) expecting a mean reversion.

Scenario 1 : The Ideal situation. X will come down and Y will go up and we make money on both the calls.

Result: Positive returns

Scenario 2 : The overall market or the banking sector falls in which case, X will fall more compared to Y as X is overvalued compared to Y and hence the long call on Y will lose less money than we make on the short position on X.

Result: Positive returns

Scenario 3 : The overall market or the banking sector moves up in which case, Y will move up far more compared to X as Y is undervalued compared to X and hence the short call on X will lose less money than we make on the long position on Y.

Result: Positive returns

Scenario 4 : Stock specific risk – This happens when both the selected stocks move in the opposite direction. While this is rare. This is taken care by diversification and hedging through stock options.

Result: Neutral/slightly negative

While this is simple example to explain the strategy, there are multiple factors including market trend, industry, beta etc which is considered before taking the position. The advisor can take cross industry/sector calls and can use options to hedge the positions as well. Multiple long-shorts/positions are run simultaneously to hedge and generate optimal returns. Constant monitoring and multiple adjustments are done to ensure better returns over the entire holding period.

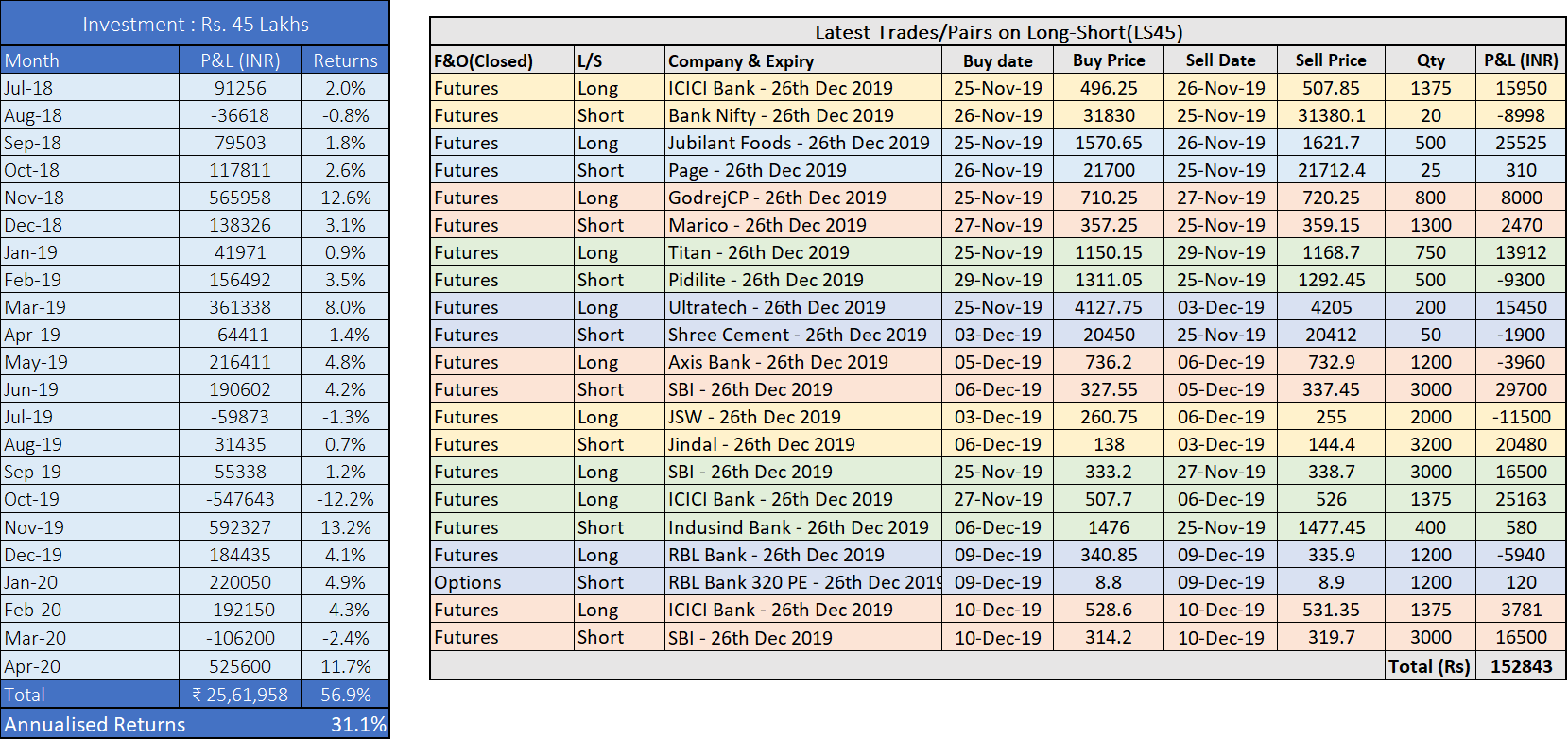

Past Performance:

An overview on Long/Short Strategies – Products, Returns, and bench marking

Investment Required: Rs 50 Lakhs+

At the core of Long-short strategy is the Market Neutral product which is regarded as ultimate of portfolio management skills can be designed on the following lines

Market & Sector Neutral: Besides, being ₹ neutral, the Net sector exposure (stocks have to be pre-categorized in different sector/cluster groups) is neutralized. While running this portfolio, the advisor cannot make sector calls. Typically, Net Beta exposure of the portfolio is minimized by default

Key success factors: Stock selection (pair trades). Running such a strategy is seen extremely difficult and challenging and depends completely on capturing the alpha spreads between the stock pairs. Globally, there aren’t many funds that can boast of reasonable returns over a sustained period of time. However, the benchmark for such a product is treasury yield. A fund that can generate 8% p.a. (with gross exposure of 4x) in US markets can attract over hundred million dollars with minimal efforts.

This product is an all-seasons absolute returns product with minimal volatility.

In Indian context, two variants of the strategy are possible:

- 200-200: with allocation of 45% in Long stock futures, 45% in Short stock futures, 10% in cash. Suitable for HNI investors. When executed well, the products should generate upward of 24% returns on invested capital every year regardless of the market conditions

- 85-85: with allocation of 85% in cash stocks, 14% in Short stock futures, 1% in cash. Suitable for HNI investors and potentially for corporate treasury (as debt products become taxable). The product will have minimal volatility, high liquidity and should generate ~16%-20% p.a. returns on invested capital

Risk Controls & Monitorables:

Market & Sector Neutral 200-200:

- Net exposure of the portfolio (measured as Total Long exposure – Total Short exposure) as a percentage of Gross exposure will be contained within -/+15% of Gross exposure

- Exposure to single stock (either on the long side or on the short side) will not exceed 15% of the Gross exposure

- Net Exposure at the sector levels will be contained within 15% of Gross exposure

- Maintaining stock positions/ exposures on a daily basis

- Calculating % returns (mtm and for the closed positions) on a daily basis

Process, Charges & other details:

- You will need to open a Demat account through us with our preferred broker, we don’t charge anything additional.

- You will have complete control of your funds and account at all times.

- Once the account is created, you may buy or sell based on our recommendation or we can execute the trades for you based on your request.

- Based on your requirement, we can work out a Quarterly or Yearly profit withdrawal or reinvest to grow your portfolio.

- This will be a professionally managed service with multiple strategies available based on the risk profile of the investor and investible corpus.

Charges :

Annual DP charges: Rs 1100/- + Tax

Brokerage : With above mentioned services/strategies – Recommendations & execution

Delivery : 0.5% & Intraday : 0.05%

Futures : 0.1% & Options : Rs 30

For opening an account, please call 9916804769 or email Invest@smartserve.co

Business/Distribution opportunity: If you are a financial adviser, Mutual fund distributor or Insurance adviser and would like to offer this to your clients, you can register with us. This will complement your existing investment offerings. Please call/email us for details of business opportunity – 9916804769 / info@smartserve.co

——————————————————————————————————————————————————

Some more details on the Long-Short Strategy…