Types of Mutual funds : There are broadly 4 main types of fund

- Equity Funds: These are funds that invest in equity stocks/shares of companies. The returns are market linked and are ideal for investors with a long-term investment

- There are multiple types of equity funds depending on the size of companies they invest in – Large cap, Mid cap, small cap and multicap.

- Large cap funds are considered safer as they invest in large companies and banks

- ELSS – Equity linked savings scheme – These funds primarily invest in large cap companies and these funds have a 3 yr lockin. These funds are eligible for tax savings under 80C. This is one of the best tax savings option available.

- Ideal time horizon is 8+ yrs, Can expect 12% to 15%+ annual returns. All returns are tax free after 1 year

- Debt Funds: These are funds that invest in Fixed income/debt instruments e.g. company debentures, government bonds and other fixed income assets. They are considered safe investments and provide stable returns.

- So for eg when the central or state govt. wants to raise some money for some projects…they will issue bonds which will have a higher return than FD. Similarly any company or banks can raise money by issuing debentures or bonds with a slightly higher interest rate. The debt funds will buy these kinds of bonds/debentures and are considered safer than equity

- Debt funds should be used for shorter time horizon. When selecting debt scheme, it is better to invest in short term bond where the maturity is in line with our investment time horizon and we also need to check the portfolio to ensure that the scheme has invested in high quality bonds…like Govt securities, bonds, treasury bills or AAA bonds.

- Ideal time horizon is 6month to 3 yrs, can expect 7% to 9% annual returns

- Money Market Funds: These are funds that invest in liquid instruments e.g. T-Bills, CPs etc. They are considered safe investments for those looking to park surplus funds for immediate but moderate returns.

- Similar to debt funds when the government or banks want to raise money for very short term – 1day to 90 days, they issue T-Bills or CPs which are considered very safe.

- Liquid/money market funds are the best used for keeping emergency funds and are a better alternative than keeping money in savings or current account

- Ideal time horizon is 1 week to 6 months, can expect 5% to 7% annual returns compared to 3.5% in savings account

- Balanced or Hybrid Funds: These are funds that invest in a mix of asset classes. In some cases, the proportion of equity is higher than debt while in others it is the other way around. Risk and returns are balanced out this way.

-

- Depending on the debt & equity mix, this can be used for a time horizon of 2 to 7 yrs or more and can expect 8% to 12% annual returns

- To get a tax free return after 1 year, choose the fund which maintains a 65%+ exposure to equity (pure equity or equity+ arbitrage)

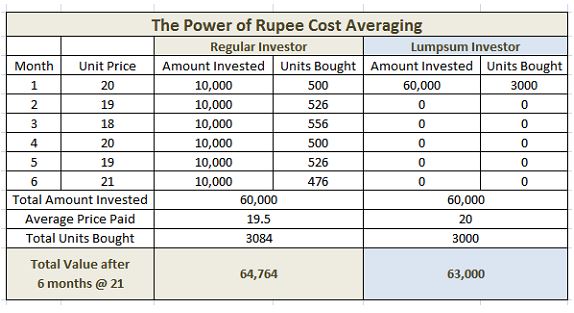

This methodology enables you to invest at any point of time and you don’t have to time the market and ensures that your avg. buying cost remains low and hence gets you better profits. More importantly this makes you a disciplined investor.

This can be used for buying shares as well as mutual funds(SIP)

Investing for Short term goals..

This has been a great year for Indian stocks. Year to date the Nifty has given nearly 25% returns. While years like 2017 are great for investor sentiment, but equity as an asset class is volatile in nature.

over the last 28 years BSE Sensex has grown at a compounded annual growth rate of over 16% -(1 Lakh investment would be 64 lakhs) But there have been many years where the markets have given negative or below 8% returns. And this is the reason for recommending minimum time horizon of 7+ years when investing in pure equity funds.

Historical data shows that equity is the best performing asset class in the long term, but in the short term equity has been volatile. While the long term India Growth Story remains intact, as evinced by the Moody’s rating upgrade, it will not be unidirectional move for equities; equity prices will move upwards but with volatility.

So where should we invest for short term goals especially when the markets are slightly overvalued.

The easy answer is Debt funds, but there are two issues with this..

The returns are low – 6 to 8% based on the type of fund

The returns are taxable under 3 yrs and are tax efficient only after 3 yrs

The returns on Equity funds are tax free post one year. So here are some equity based funds which would be suitable for lower tenure..

Balanced funds (for 4 to 7 yrs tenure) –

These funds have 65% in equity and the rest in debt. The equity exposure gives growth and debt gives stability. While balanced funds have a lower risk profile than equity funds, most balanced funds in India are aggressive in nature because they have minimum 65% exposure to equities to enjoy equity taxation.

Equity Savings funds : (for tenue less than 4 yrs) –

Equity savings funds invest the total corpus in three parts: one-third in debt, one-third in arbitrage and one-third in pure equity. So there is only 33.33% exposure to pure equity which makes them less-riskier than balanced funds,

While in a Bull Market a balanced fund would give better returns but during a crash or downturn, the equity savings funds are better protected.

Balanced Advantage funds/Asset allocation funds (for tenue less than 7 yrs) –

These funds have dynamic asset allocation strategy determined by equity valuations. Pure Equity allocation can range between 30 – 80% based on the market conditions and valuations. The portfolio is actively managed and when the equity valuations are high, the equity exposure can be reduced to 30% and hence reduces the risk and when the market valuations are reasonable/low…the equity exposure can be increased to 70-80% to generate better returns. The balance of the portfolio is debt and derivatives.

This is where we use SWP – SWP is Systematic withdrawal plan – It is a service offered by mutual funds for investors who want regular income. This option can offer Regular Income, Capital appreciation and tax affective returns.

The intent is to move our corpus to a comparatively safer fund like a balanced/hybrid fund and withdraw only a certain %, which should ideally be lesser than the funds growth percentage. This will ensure that while we continue to withdraw the amount but it doesn’t deplete our principle/initial corpus. We should leave a certain % of growth which should ideally be slightly higher or at least equivalent to inflation…This will ensure that the value of your capital is sustained. For eg..if you expect the fund to grow at 15% annually and the inflation is 6%, you should withdraw only 8%/annum and the balance 7% is used to grow/protect your principle value.

Let me explain with a detailed example…

If you had invested Rs 15 Lakhs in a mutual fund that generated 15%-16% annual returns. You can withdraw Rs 10000/- every month for 10 yrs and still have almost 30 lakhs at the end of 10 yrs. What we have done here is withdraw only 8% (1.2 Lakh/annum) and the balance 7-8% has helped the principle of 15 Lakhs to grow to 30 Lakhs in 10 yrs.