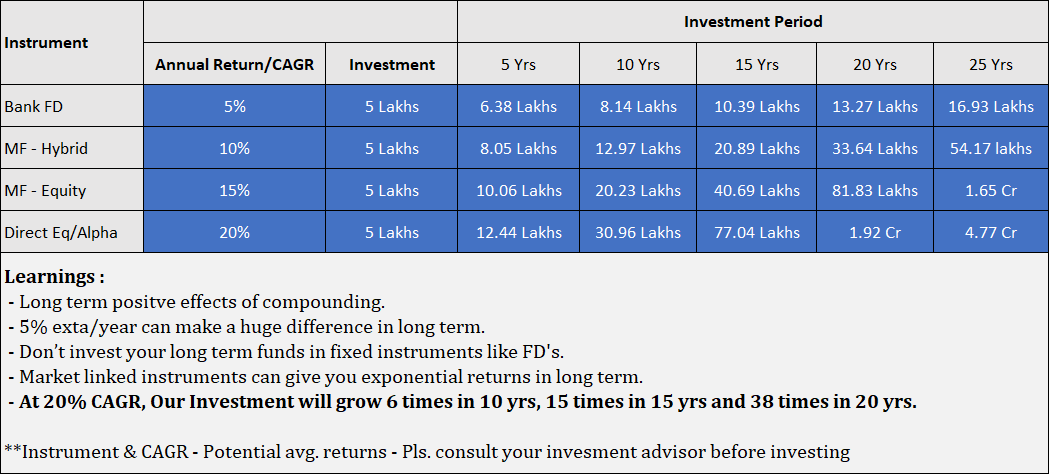

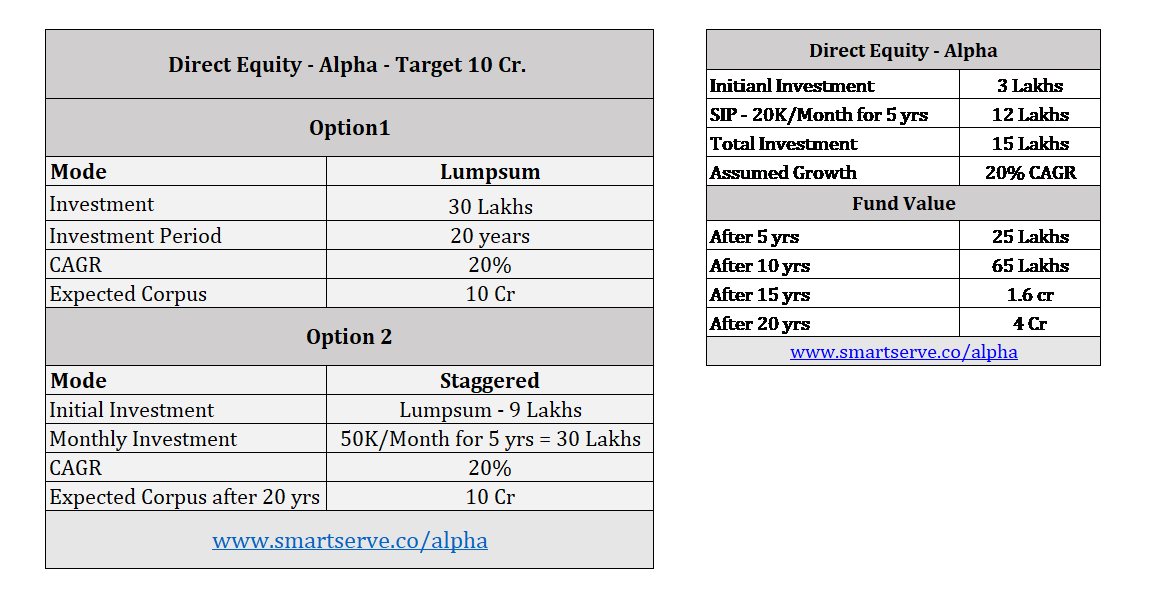

While the traditional PMS is designed for HNI’s where the minimum investment is 50 lakhs, Our product caters to both Retail & HNI clients where you can start from 5 lakhs or even less…

Investment Advisor :

Our Investment advisor has 15 yrs of experience and is SEBI certified. He has worked with Aditya Birla money and Reliance capital in the past and is also a consultant for a Hedge fund.

Research & Strategy :

We specialise in research to identify opportunities in the short to medium term through the Information and analytical edge which we have developed over many years. We maintain a database of 240+ stocks with historical quarterly data for many years. This includes all the financial and operational data along with all stock specific sensitivity data, corporate announcements & news all the way to any commodity or raw material cost fluctuations which could impact the stock price movement. We also analyse and record information from the research reports/sell side research of various renowned institutions like JP Morgan, Credit Suisse, Morgan Stanley, Citi, Goldman Sachs, Jefferies, UBS & Kotak. We also have access to Reuters terminal and use Reuters Eikon and Smart estimate to research and analyse financials, valuation mismatch, estimate revisions, future and Consensus estimate etc. Our expertise of 15 yrs in the market coupled with this database of information and the analytical edge of relating this to stock price movement helps us identify opportunities ahead of the general market/price movement.

Trading Alpha: (A non-discretionary portfolio)

Investment Required: Rs 5 Lakhs+

The strategy aims to capture the short term changes in stock price in response to new information. The product caters to investors who wants to take short term exposure in stock market.

The features of the product are as follows:

➢ Recommendations of Stocks are selected from stocks trading in F&O segment.

➢ Calls are generated using fundamental, momentum and event based strategies.

o Fundamental : Includes catalyst driven idea, Potential earnings surprises leading to consensus upgrades.

o Momentum : High in earnings momentum combined with positive news flow, Accelerated near term earnings.

o Event & News Based : Synergies from M&A, Buybacks, Rating upgrade, Positive regulatory actions, Supply disruption, Corporate restructuring announcement, etc.

➢ Each stock recommendation should be allocated with maximum exposure of 10%-15% of trading capital.

➢ The return target of stocks recommended will be in the range of 5-10%, Normal holding period will be 2-5 weeks.

➢ Probability of success is 70-80% and there is no stop loss as such, exit of positions will be communicated.

➢ Maximum 10 calls might be open at any point of time.

The capital allocation is 10-15% in any stock and investment is diversified across 8-10 stocks. Only the top tier stocks/companies are selected and they are selected based on fundamental study & valuation gap and hence the risk of penny stocks, small caps are non-existent. Also, the Rationale/reason for each buy/sell is shared with the clients. The good part is while all the research and execution(buy&sell) are taken care by us…The Client remains in full control of the funds and investments at all time and can withdraw anytime.

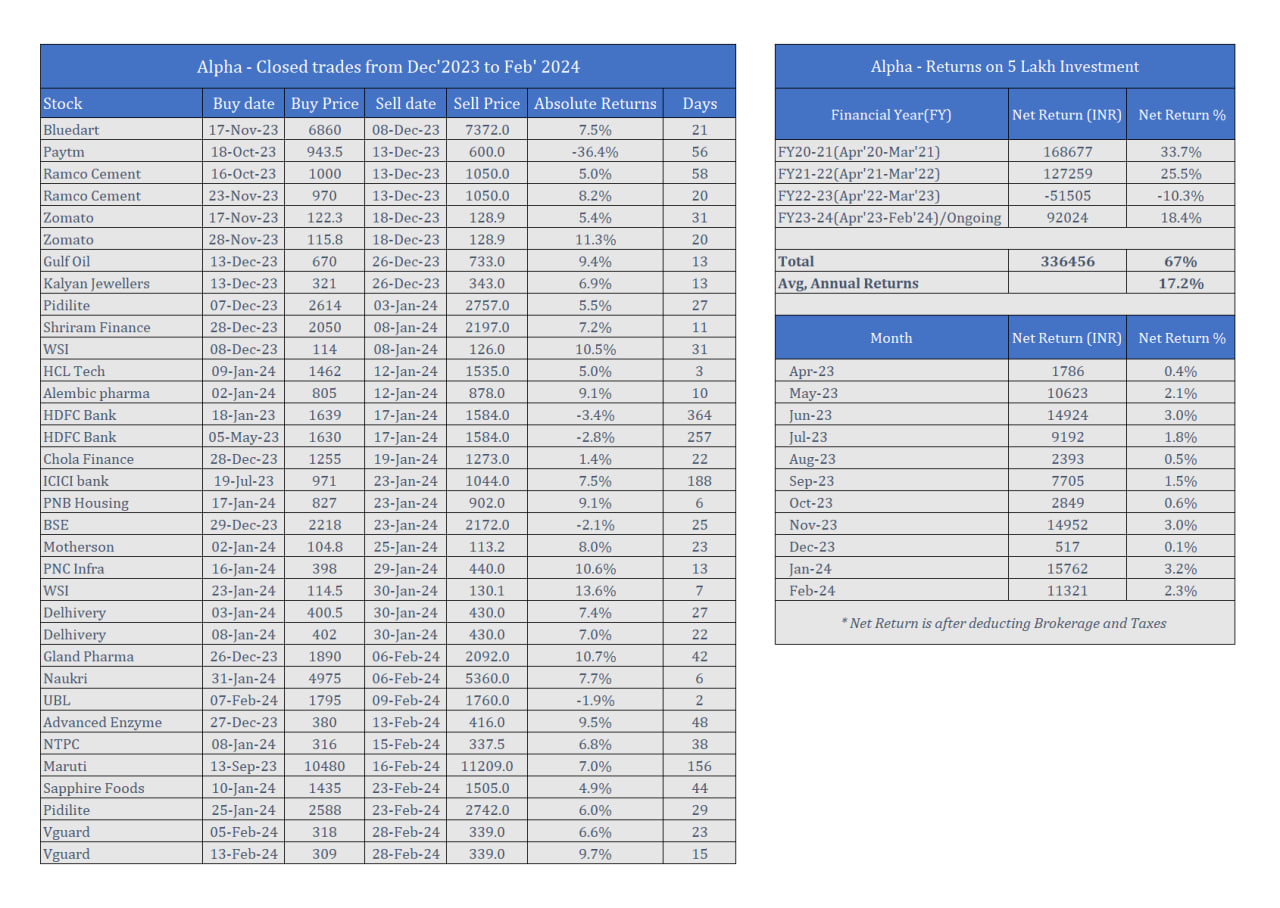

Past Performance :

Process, Charges & other details:

• You will need to open a Demat account through us with our preferred broker.

• You will have complete control of your funds and account at all times and can withdraw anytime you want.

• Once the account is created, you may buy or sell based on our recommendation or we can execute the transactions on your behalf.

• Clients profitability will be the top priority, we will not churn your portfolio to just gain brokerage/commission.

• Rationale/Logic for every transaction (Buy & Sell) will be explained to the client.

• The intent will be to generate above average returns by identifying fundamentally strong companies with good growth prospects with fair valuations.

• Based on your requirement, we can work out profit withdrawal or reinvest to grow your portfolio.

• Regular reports and on demand reports are shared with the client to keep them updated on the P&L.

Charges : Annual DP charges: Rs 599/- + Tax

Brokerage :

With above mentioned services/strategies – Recommendations & execution

Delivery : 0.5% & Intraday : 0.05%

If you would like to test our services and would like a free trial, please call or whatsapp at 9916804769

If you are a financial adviser, Mutual fund distributor or Insurance adviser and would like to offer this to your clients, you can register with us. This will complement your existing investment offerings of mutual funds and Insurance. Please call us for details of business opportunity.

For any further details, please call 9916804769 or email Invest@smartserve.co

Thanks & Regards

Robin